Exploring the Benefits of a Debt Administration Strategy in Regaining Control Over Your Financial Resources and Improving Your Credit Scores Score

The application of a Financial obligation Administration Plan (DMP) offers a structured strategy for people seeking to restore control over their finances and improve their credit rating. By settling financial obligations and discussing beneficial terms, a DMP can alleviate the burden of numerous repayments, thus cultivating a more manageable economic landscape. This calculated tool not only simplifies budgeting yet additionally has the prospective to enhance credit reliability over time. However, recognizing the nuances and lasting ramifications of a DMP is crucial for making notified choices that can bring about monetary empowerment. What should one consider before embarking on this course?

Recognizing Debt Administration Program

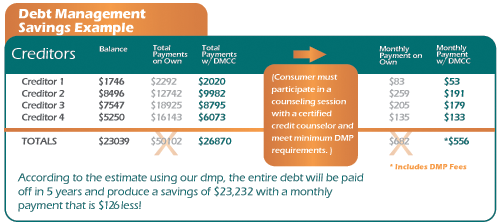

An extensive understanding of Financial debt Management Plans (DMPs) is essential for individuals looking for a reliable solution to their financial difficulties. A DMP is a structured payment strategy made to aid individuals handle their unsecured debts, such as bank card and individual car loans, in a much more manageable way. Usually provided by credit rating counseling agencies, DMPs enable individuals to consolidate their debts into a solitary monthly settlement, which is after that distributed to lenders.

The key purpose of a DMP is to lower the total monetary problem by working out lower rate of interest and forgoing charges with financial institutions. This setup often makes it possible for people to settle their financial debts within a defined duration, normally three to 5 years. Furthermore, DMPs can supply important financial education and learning and assistance, empowering customers to establish better budgeting habits and boost their general monetary literacy.

Exactly How DMPs Simplify Payments

One of the crucial benefits of a Debt Administration Plan (DMP) is the simplification of month-to-month repayments for people dealing with numerous financial debts. Under a DMP, a credit report therapy firm consolidates various debts into a solitary month-to-month settlement. This procedure removes the complication and stress often connected with handling multiple financial institutions, each with various payment days and quantities.

With a DMP, people make one consolidated payment to the credit report therapy company, which then disperses the funds to financial institutions on their part. This structured strategy not just relieves the concern of remembering numerous settlement timetables however also reduces the chance of missed out on repayments, which can result in additional costs or fines.

Additionally, the predictability of a solitary regular monthly payment can aid individuals in budgeting better, enabling them to assign funds towards other vital expenses. debt management plan singapore. As an outcome, numerous DMP individuals report a substantial reduction in monetary anxiety, enabling them to gain back control over their finances. On the whole, the simplification of settlements via a DMP represents a crucial action for people aiming to attain monetary security and ultimately enhance their general creditworthiness

Lowering Rate Of Interest With DMPS

By entering into a DMP, participants may see their rate of interest decreased considerably-- sometimes by as high as 50% or even more. This reduction straight equates into reduced regular monthly payments, permitting individuals to allocate even more funds towards principal repayment as opposed to interest. Subsequently, this method not just alleviates monetary tension yet likewise accelerates financial obligation settlement, as even more of each repayment approaches minimizing the overall balance.

Moreover, reduced rates of interest can develop a more organized approach to financial obligation repayment, improving the chance of completing the plan efficiently. This streamlined procedure encourages participants to gain back control over their economic situation, promoting a sense of achievement and leading the means for future financial stability. Inevitably, the benefits of decreased passion prices through a DMP can be transformative for those seeking to get over debt difficulties.

Influence on Your Credit Rating

Getting In a Financial Debt Administration Plan (DMP) not just assists in discussing reduced rate of interest yet likewise has implications for your credit report. When you register in a DMP, your creditors might report your involvement to credit scores bureaus, which can initially mirror as a negative mark. This is due to the fact that the DMP suggests that you are seeking help to manage your financial debts, suggesting possible monetary distress.

However, as you continually pay via the DMP, your credit report can progressively enhance. Prompt payments add favorably to your repayment background, which is a significant consider credit history designs. Moreover, minimizing total financial obligation degrees can enhance your credit usage proportion, more benefiting your score.

It's important to note that while going into a DMP might cause a short-term dip in your credit history, the lasting these details results can be favorable. Effectively completing a DMP shows financial responsibility and a commitment to settling financial debts, which creditors may check out favorably in future analyses. By doing this, a DMP can be a tactical relocation to not only restore control over your finances however likewise lead the way for improved credit report wellness with time.

Long-Term Financial Benefits

Taking control of your financial scenario via a Financial obligation Administration Plan (DMP) can generate significant long-term benefits that extend beyond instant debt relief. Among the key benefits is the establishment of a structured payment strategy, which cultivates regimented economic practices. This disciplined strategy not just aids in the prompt payment of financial debts yet likewise encourages far browse around this site better budgeting methods, leading to boosted source allocation.

In Addition, a DMP often causes decreased rates of interest and waived fees, allowing you to pay off your financial obligations much more successfully. As debts reduce, the possibility of gathering new financial debt decreases, leading the way for a much more stable monetary future.

With time, effectively finishing a DMP can enhance your creditworthiness. debt management plan singapore. Improved credit rating assist in accessibility to lower rate of interest prices on future fundings, ultimately resulting in considerable financial savings on mortgages, car finances, and various other monetary items. Additionally, attaining financial stability can supply tranquility of mind, reducing tension and permitting much better monetary planning, like saving for retirement or investments

Basically, the long-lasting monetary benefits of a DMP incorporate improved financial health, increased creditworthiness, and improved general high quality of life.

Conclusion

In summary, Debt Administration Program (DMPs) offer significant advantages for people looking for to reclaim economic control and boost credit report. By combining financial obligations into manageable settlements and bargaining reduced rate of interest, DMPs promote budgeting and minimize the danger of missed settlements. Gradually, regular adherence to a DMP can bring about better credit rating ratings and lasting monetary stability. Ultimately, the implementation of a DMP functions as a calculated method to overcoming economic difficulties and fostering a healthier financial future.

By visit this website settling debts and bargaining positive terms, a DMP can reduce the problem of numerous payments, therefore cultivating an extra workable monetary landscape.A comprehensive understanding of Financial debt Monitoring Plans (DMPs) is necessary for people seeking an effective option to their economic obstacles.One of the vital advantages of a Financial obligation Monitoring Strategy (DMP) is the simplification of month-to-month payments for individuals battling with numerous financial debts (debt management plan singapore).Taking control of your monetary scenario via a Financial debt Monitoring Strategy (DMP) can produce considerable long-lasting benefits that prolong beyond instant financial obligation alleviation.In recap, Financial debt Monitoring Program (DMPs) supply substantial benefits for individuals seeking to restore financial control and enhance credit history scores